Image Credit: LiveMint, Economic Times, OneIndia

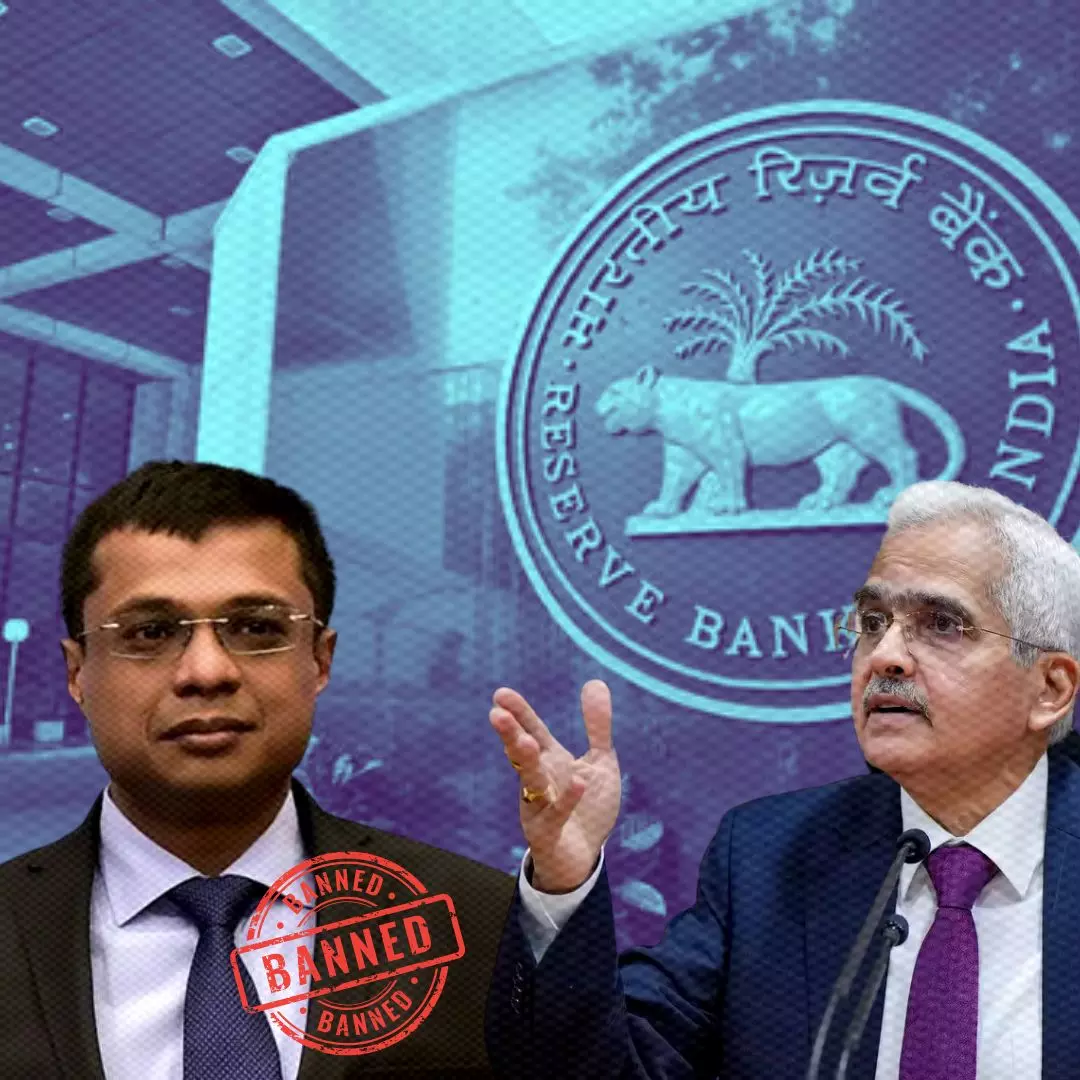

RBI Bans Flipkart Founder Sachin Bansal’s Navi Finserv From Issuing Loans

Writer: The Logical Indian Crew

We are an independent and public-spirited digital media platform for Indian millennials. We report news and issues that matter as well as give you the opportunity to take action.

India, 18 Oct 2024 5:52 AM GMT

Editor : The Logical Indian Team |

We are an independent and public-spirited digital media platform for Indian millennials. We report news and issues that matter as well as give you the opportunity to take action.

Creatives : The Logical Indian Crew

We are an independent and public-spirited digital media platform for Indian millennials. We report news and issues that matter as well as give you the opportunity to take action.

RBI halts loan disbursements for Navi Finserv and three other NBFCs due to excessive interest rates and regulatory non-compliance, impacting their operations from October 21, 2024.

The Reserve Bank of India (RBI) has prohibited Navi Finserv, led by Flipkart co-founder Sachin Bansal, along with three other non-banking financial companies (NBFCs), from issuing new loans effective October 21, 2024. This action is a response to excessive interest rates and non-compliance with regulatory guidelines. The RBI's directive aims to address supervisory concerns regarding pricing policies and loan assessment practices, ensuring compliance and fair lending practices.

RBI Takes Firm Action Against Excessive Lending Practices

On October 17, 2024, the Reserve Bank of India (RBI) announced a ban on Navi Finserv, Asirvad Micro Finance, Arohan Financial Services, and DMI Finance from sanctioning and disbursing loans. The ban will take effect from the close of business on October 21, 2024. The RBI cited "material supervisory concerns" related to the companies' pricing policies, particularly their Weighted Average Lending Rate (WALR) and the interest spread over their cost of funds, which were deemed excessive and in violation of regulations. The central bank emphasized that while these restrictions will halt new loan disbursements, they will not affect existing loan servicing or collections.

Background on Regulatory Oversight

The RBI's decision follows ongoing concerns regarding unfair lending practices within the NBFC sector. In recent months, the RBI has been actively engaging with regulated entities to promote responsible use of regulatory freedoms and ensure fair pricing for small-value loans. Despite these efforts, the RBI found continued instances of "usurious practices" during examinations of the concerned NBFCs. Additional issues included discrepancies in household income assessments and inadequate disclosure of interest rates and fees. The RBI has stated that it will reconsider the restrictions once these companies demonstrate compliance with regulatory guidelines and remedial actions are taken.

Questions and Answers

1. Why did the RBI take action against certain NBFCs?

The RBI found excessive interest rates and non-compliance with its regulations among these companies, particularly concerning their pricing policies related to lending rates.

2. What are the immediate effects of this ban?

The affected NBFCs must stop issuing new loans but can continue servicing existing loans and collecting repayments from current customers.

3. When will this ban come into effect?

The prohibition will be enforced starting from the close of business on October 21, 2024.

4. What specific compliance issues were identified by the RBI?

Issues included excessive pricing practices, inadequate assessment of borrowers' incomes, irregularities in loan classification, and insufficient disclosure of fees.

5. What must these companies do to lift the ban?

They need to demonstrate corrective actions that align with RBI guidelines on pricing policy, risk management processes, customer service, and grievance redressal.

The Logical Indian's Perspective

The Logical Indian advocates for transparency and fairness in the financial services sector. The RBI's decisive action against Navi Finserv and other NBFCs underscores the necessity for stringent oversight to protect consumers from exploitative lending practices. As we move towards a more equitable financial landscape, it is crucial for all stakeholders to prioritize ethical standards and responsible lending. How do you think stricter regulations will impact the future of microfinance in India? Share your thoughts!

All section

All section