Image Credit: Unsplash

Viral Posts Falsely Claim That State Governments Levy 55% Tax On LPG Cylinders

Writer: Jakir Hassan

A journalist at heart loves the in-depth work of reporting, writing, editing, research, and data analysis. A digital and social media enthusiast.

India, 26 July 2021 12:34 PM GMT | Updated 26 July 2021 12:38 PM GMT

Editor : Bharat Nayak |

As the founding editor, Bharat had been heading the newsroom during the formation years of the organization and worked towards editorial policies, conceptualizing and designing campaign strategies and collaborations. He believes that through the use of digital media, one could engage the millennial's in rational conversations about pertinent social issues, provoking them to think and bring a behavioral change accordingly.

Creatives : Jakir Hassan

A journalist at heart loves the in-depth work of reporting, writing, editing, research, and data analysis. A digital and social media enthusiast.

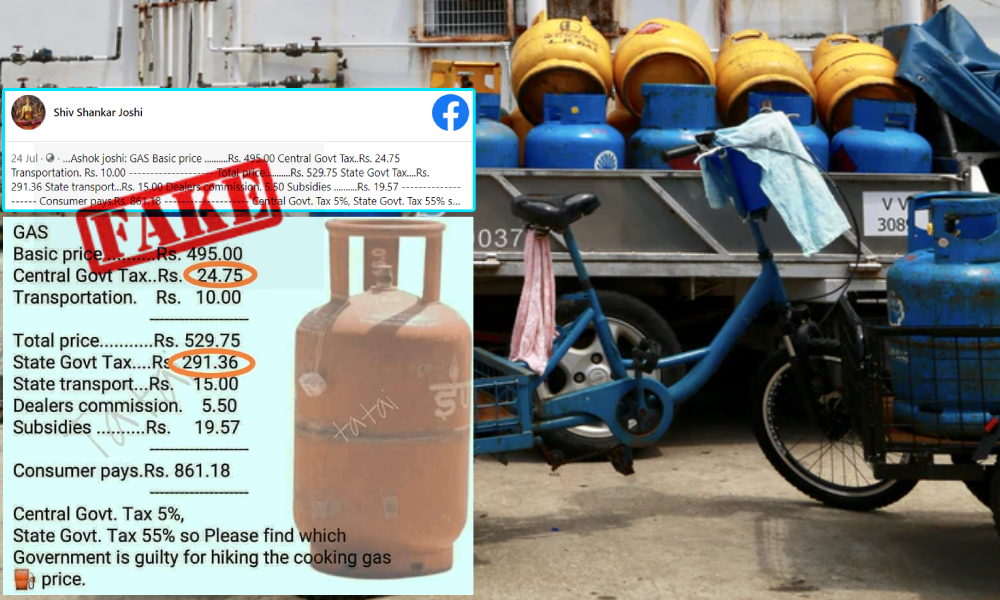

Amid the rising fuel and LPG prices in the country, posts are viral claiming that the central government levies only 5% tax on LPG cylinders and the state governments charge a whopping 55% tax. The Logical Indian Fact Check team verifies the claim.

Amid the rising fuel and LPG prices in the country, posts are viral claiming that the central government levies only 5% tax on LPG (Liquefied Petroleum Gas) cylinders and in contrast, whereas the state governments charge a whopping 55% tax. The viral posts constitute a price break-up of an LPG cylinder. An LPG cylinder price includes basic price, transportation charges, dealer's commission, subsidies, and the taxes levied by state and central government.

The chart breaks down the cost and is followed by a statement at the end. The statement reads, "Central Govt. Tax 5%, State Govt. Tax 55% so Please find which Government is guilty of hiking the cooking gas price".

The post is viral on Facebook.

The post is viral on Twitter too.

Claim:

The central government levies only 5% tax on LPG cylinders, whereas the state governments charge 55% tax.

Fact Check:

It is noteworthy that the viral posts neither mention the source of the data nor mention any particular state that follows this tax system. It is vital as the price of an LPG cylinder varies from state to state.

The domestic LPG grades have been taxed under the Goods and Services Tax (GST) since 2017. The central and state government do not levy separate taxes on the LPG cylinders.

According to the Central Board of Indirect Taxes and Customs (CBIC) website, domestic LPG cylinders fall under the 5% GST slab. It is shared equally between the centre and state governments (CGST – 2.5% + SGST – 2.5%). The GST slab can be accessed on the CBIC website.

The government of India issued a circular dated 31 December 2018 subjected, 'Clarification regarding GST rates & classification (goods)–reg'. According to the circular, domestic LPG is taxed at 5% (Details can be accessed on page 5).

Petroleum Planning and Analysis Cell (PPAC) published a report under the Ministry of Natural Gas and Petroleum in May 2021. It provides the break-up of the taxes levied on domestic LPG (Details can be accessed on page 35).

The posts claim that the dealer's commission is given at Rs 5.50; however, according to PPAC, the dealer's commission is at Rs 61.84 on a 14.2 kg LPG gas cylinder.

The government had revised the distributor's commission to Rs 61.84 and issued an order for the same in July 2019.

The post claims that subsidy is given at Rs 19.57; however, the government has not provided an LPG subsidy since last year. The price break-up can be accessed at the PPAC website.

Furthermore, LPG pricing in India is determined by several factors, including location and import parity price and is revised monthly.

Therefore, we can conclude that the viral posts claiming that the central government levies only 5% tax on LPG (Liquefied Petroleum Gas) cylinders, whereas the state governments charge a whopping 55% tax is false. It is shared equally between the centre and state governments.

If you have any news that you believe needs to be fact-checked, please email us at factcheck@thelogicalindian.com or WhatsApp at 6364000343.

Also Read: Old Video Of Attack On Rajasthan MLA Shared As Recent With False Claim

All section

All section