Making Online Payments? Here's All You Need To Know About New Credit, Debit Card Rules Effective July 1

Writer: Shashwat Swaroop Garg

My name is Shashwat Swaroop Garg, I'm 21 years old and I am from Kanpur, Uttar Pradesh. I am a media student at Symbiosis Institute of Media and Communication, Pune. I am currently pursuing my specialization in Journalism. I am interested in playing videogames, reading and learning about new and interesting things and I work well in a team

India, 22 Jun 2022 12:21 PM GMT

Editor : Shiva Chaudhary |

A post-graduate in Journalism and Mass Communication with relevant skills, specialising in content editing & writing. I believe in the precise dissemination of information based on facts to the public.

Creatives : Shiva Chaudhary

A post-graduate in Journalism and Mass Communication with relevant skills, specialising in content editing & writing. I believe in the precise dissemination of information based on facts to the public.

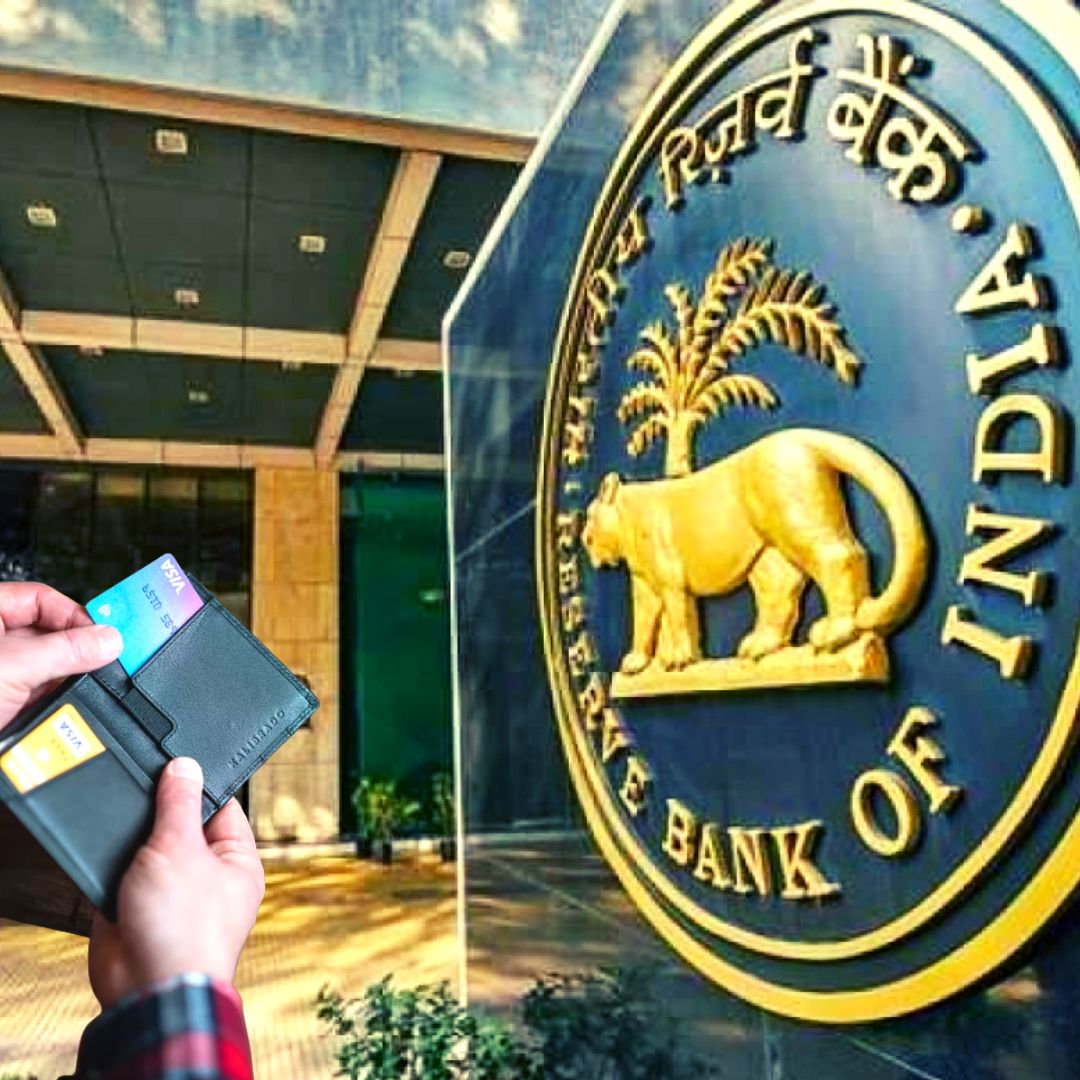

Online merchants in India will not be allowed to store customers' data on their servers after the implementation of RBI's new debit and credit card tokenisation rule, which will protect customers' privacy.

The Reserve Bank of India has stated that the payment ecosystem in India is prepared to adopt the credit and debit cards tokenisation rule from July 1. Earlier, the deadline for this rule was extended from January 1 to July 1.

Online merchants in India will not be allowed to store customers' data on their servers after the implementation of the debit card and credit card tokenisation rule. RBI said that this is being done in order to protect the privacy of the customers.

What Does This Rule Mean?

In a report by News18, according to the RBI website, "Tokenisation refers to the replacement of actual card details with an alternate code called the "token", which shall be unique for a combination of card, token requestor and device."

RBI also said on its website that the token contains no personal information that can be accessed directly and keeps changing occasionally, making it the most secure method to complete online payments.

Once the credit card and debit card tokenisation is complete, online merchants, online wallets and other payment services will be unable to save a customer's card data, including card number, CVV, date of expiration and additional sensitive information. Customers have already received alerts from banks and merchants to tokenise their cards.

The tokenisation process is not mandatory, however. If the customer does not tokenise their cards by July 1, they will have to re-enter their card details while making online purchases, as all of the existing data on the server will be deleted.

Benefits Of Card Tokenisation

According to the NDTV report, tokenisation of credit and debit cards will ensure more secured online transactions because the online merchants will not have any customers' data.

According to the State Bank of India website, a tokenised card transaction is considered safer as the actual card details are not shared/stored with the merchants to perform the transaction.

Customers will experience smoother and faster checkouts as tokenised cards do not require the card number, name of the cardholder and expiration date. However, CVV and OTP authentication will still be there as an added layer of protection for the customers.

Also Read: Alarming! New Study Reveals Sitting In Office For Over 8 Hours Increases Heart Disease Risk By 50%

All section

All section